Highlights

Results by Business Segment

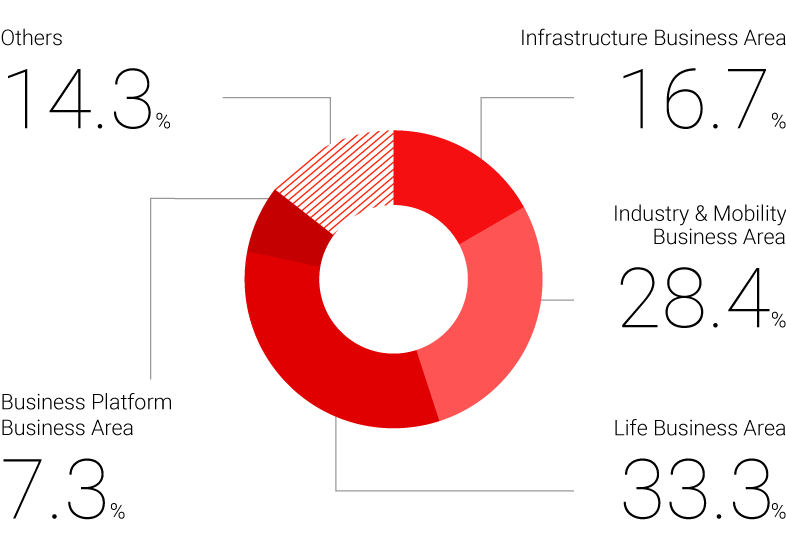

Revenue breakdown by business segment

(Year ended March 31, 2022)

Energy and Electric Systems

(Year ended March 31, 2022)

The market for the social infrastructure systems business saw buoyant investment in the public utility business in Japan, while demand relating to power systems decreased in Japan and there was the reconsideration of the capital expenditure plans by railway companies in Japan due to the impact of COVID-19. In this environment, orders won by the business remained substantially unchanged compared to the previous fiscal year due primarily to an increase in the public utility systems business in Japan despite a decrease in the power systems and the transportation systems businesses in Japan. Revenue decreased compared to the previous fiscal year due mainly to decreases in the power systems and the transportation systems businesses in Japan.

The market for the building systems business saw recovery from stagnation stemming from COVID-19 primarily in China, while recovery is delayed in some parts of Asia. In this environment, the business saw increases in both orders and revenue compared to the previous fiscal year due mainly to an increase primarily in China.

As a result, revenue for this segment decreased by 3% compared to the previous fiscal year to 1,238.1 billion yen.

Operating profit decreased by 46.7 billion yen compared to the previous fiscal year to 62.1 billion yen due mainly to decreased revenue and a shift in project portfolios.

<Main Products and Business Lines>

Turbine generators, hydraulic turbine generators, nuclear power plant equipment, motors, transformers, power electronics equipment, circuit breakers, gas insulated switchgears, switch control devices, surveillance-system control and security systems, transmission and distribution ICT systems, large display devices, electrical equipment for locomotives and rolling stock, wireless and wired communications systems, network cameras and their systems,

elevators,

escalators, building security systems, building management systems, and others

Industrial Automation Systems

(Year ended March 31, 2022)

The market for the factory automation systems business saw a global increase in demand for capital expenditures relating to digital equipment such as semiconductors, electronic components and smartphones, and products in the decarbonization area such as lithium-ion batteries. In this environment, the business saw increases in both orders and revenue compared to the previous fiscal year.

The market for the automotive equipment business saw an increase in electric vehicle-related equipment due to the expansion of electric vehicle market, while sales of new cars decreased in Japan, China Europe and the U.S. due primarily to a semiconductor shortage compared to the previous fiscal year. In this environment, the business saw increases in both orders and revenue compared to the previous fiscal year due mainly to increases in electric vehicle-related equipment such as motors and inverters, as well as electrical components.

As a result, revenue for this segment increased by 17% compared to the previous fiscal year to 1,460.3 billion yen.

Operating profit for this segment increased by 56.2 billion yen compared to the previous fiscal year to 96.8 billion yen, as operating profit for the factory automation systems business increased due mainly to increased revenue and the yen depreciating against other currencies, while operating profit for the automotive equipment business decreased due primarily to the rise in material prices and logistics costs.

<Main Products and Business Lines>

Programmable logic controllers,

inverters,

servomotors,

human-machine interface, motors, hoists, magnetic switches, no-fuse circuit breakers, short-circuit breakers, transformers for electricity distribution, time and power meters, uninterruptible power supply, industrial fans,

computerized numerical controllers,

electrical discharge machines,

laser processing machines,

industrial robots, clutches,

automotive electrical equipment,

electric powertrain system,

ADAS-related products,

car electronics and car mechatronics,

car multimedia, and others

Information and Communication Systems

(Year ended March 31, 2022)

The market for the information systems and service business saw a decrease in large-scale projects for the IT infrastructure service business, while delayed system development projects restarted, particularly in the manufacturing industry. In this environment, the business saw an increase in orders but a decrease in revenue compared to the previous fiscal year.

The electronic systems business saw an increase in orders compared to the previous fiscal year due primarily to an increase in large-scale projects for the defense systems business, while revenue decreased compared to the previous fiscal year due mainly to a decrease in large-scale projects for the defense systems business.

As a result, revenue for this segment decreased by 7% compared to the previous fiscal year to 354.1 billion yen.

Operating profit decreased by 1.7 billion yen compared to the previous fiscal year to 14.7 billion yen due mainly to decreased revenue.

<Main Products and Business Lines>

Satellite communications equipment,

satellites, radar equipment, antennas, missile systems, fire control systems, broadcasting equipment, network security systems, information systems equipment, systems integration, and others

Electronic Devices

(Year ended March 31, 2022)

The market for the electronic devices business saw recovery in demand for power modules used in consumer, industrial and automotive applications. In this environment, the business saw an increase in orders compared to the previous fiscal year and revenue also increased by 18% compared to the previous fiscal year to 241.4 billion yen due primarily to an increase in power modules used in consumer, industrial and automotive applications.

Operating profit increased by 10.5 billion yen compared to the previous fiscal year to 16.8 billion yen due mainly to increased revenue.

<Main Products and Business Lines>

Power modules,

high-frequency devices,

optical devices,

LCD devices, and others

Home Appliances

(Year ended March 31, 2022)

The market for the home appliances business saw an increase in demand for residential air conditioners primarily in Europe and North America as working from home becomes common, despite the impact of a semiconductor shortage. Demand for industrial air conditioners also recovered gradually as capital expenditures started to recover from the impact of COVID-19. In this environment, the business saw an increase in revenue by 10% compared to the previous fiscal year to 1,144.7 billion yen due mainly to an increase in air conditioners primarily in Europe and North America as well as the yen depreciating against other currencies, despite a decrease in air conditioners in Japan due primarily to a semiconductor shortage.

Operating profit decreased by 4.8 billion yen compared to the previous fiscal year to 70.9 billion yen due mainly to the rise in material prices and logistics costs despite increased revenue and the yen depreciating against other currencies.

<Main Products and Business Lines>

Room air conditioners, package air conditioners, chillers, showcases, compressors, refrigeration units, air-to-water heat pump boilers, ventilators, hot water supply systems, IH cooking heaters, LED bulbs, indoor lighting, LCD televisions, refrigerators, electric fans, dehumidifiers, air purifiers, vacuum cleaners, jar rice cookers, microwave ovens, and others

Others

(Year ended March 31, 2022)

Revenue increased by 12% compared to the previous fiscal year to 676.2 billion yen due primarily to increases in materials procurement and logistics.

Operating profit increased by 8.3 billion yen compared to the previous fiscal year to 21.9 billion yen due mainly to increased revenue.